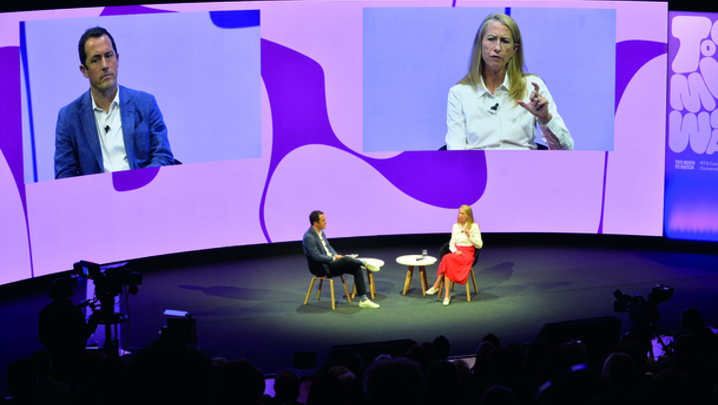

Many of the key players in the contest to land the most desirable sports rights in UK media were gathered on stage for this session

The spiralling cost of sports rights, the rise of women’s football and the threat that big tech companies pose to traditional broadcasters were some of the subjects covered in a lively session on the sporting media landscape.

Kicking off the discussion, session host Ade Adepitan asked whether the cost of sports rights had peaked? “We are facing intrinsic rights value headwinds,” admitted Warner Bros. Discovery Sports executive Andrew Georgiou, not least the concerns about the impact of increasing competition.

Nevertheless, he said, “the reality of sports rights is a little bit different because, ultimately, you also have to think about the competition in the market when you’re bidding for those rights.

“You’ve got to marry up the long-term structural headwinds of cable television, while protecting profitability, and at the same time warding off competitors coming into the market.”

Georgiou continued: “We’ve seen across Europe that [the market] is correcting itself – we are seeing lower sports rights… it does feel like we are at the top of the cycle.”

DAZN boss Shay Segev pointed out, however, that women’s sport is “probably at the beginning of its cycle but, broadly speaking, if we’re looking at the moment, you’re right. I totally agree with Andrew… rights are at their peak.”

Sky’s Stephen van Rooyen added: “It’s a mixed bag; some rights will go up, some will go down…. We take a rational and disciplined view of what those rights are worth to us as a business.”

“Show me the money, boys!” roared women’s football chief Dawn Airey. “This is an extraordinary statistic from Deloitte [I read] a couple of years ago: women’s sports rights globally – [and] that includes money taken at the gate and money paid in terms of licensing and sponsorship – is $1bn.

“Would you hazard a guess as to what the equivalent number is for men’s sport? $471bn.… That is a massive, massive opportunity for the women’s game.”

Airey pointed out that 29 million people in the UK watched some of the recent women’s World Cup. “Of that, 11.5 million had never watched a men’s World Cup… there is a new audience for sport.

“Women’s football has the potential to be one of the biggest sports globally. It’s number four in terms of viewership in the UK; we’ve seen massive increases in attendances and [broadcast] audiences; we’ve seen an explosion in social engagement.

“We are about to take our rights to market and I have to tell you we’re expecting a very big increase.”

Van Rooyen offered a note of caution: “We’ve had an incredible 12 months, particularly with the Lionesses, but there is a long way still to go to close the gap between a big men’s football game and a women’s football game… we’re on that climb and we should be on that climb.

“It is good business sense to pursue it… and it’s the right thing to do. As sports broadcasters, we have a responsibility to muscle this through.”

Airey is looking to innovate in the women’s game: “All of the insight that we’ve got about the audiences for women’s football is that they do expect to be able to get closer to the game.

“There are a lot of innovations that you could do. Why can’t, and I’m not saying this is about to happen… we mic up refs or have cameras on the bench [to] get a more intimate experience? Certainly, in the women’s game, that’s what the fans want.

“You can get closer to grassroots [football] and fandom through social [media], but you’ve got to do that through linear TV as well because you want that big match-day experience.”

Georgiou said: “Linear television and big-screen experiences for sport remain the predominant way of watching the content… for most audiences. But, he added: “The engagement opportunity that digital delivery provides is significant. We always hear about Gen Z and the millennials having short attention spans for sport – it’s just not the case… just look at gaming, for example, if it’s engaging, they will engage… and watch for longer.”

'Fundamentally, sport is local content'

Van Rooyen said that innovations, such as The Hundred or IPL in cricket, “bring in new audiences and allow better storytelling for different types of audience and that is good”.

And, added Georgiou: “More is not necessarily better – you want more premium content that cuts through.… Volume and long-tail content that has minimal impact doesn’t suit anyone’s agenda.”

Adepitan asked whether sports broadcasters’ primary audiences remained local, or if they were now prioritising international viewers. “We start with our local audience – we are here to serve fans of respective sports and leagues in the countries in which we operate,” replied Van Rooyen. “There are very few sports that travel globally and have the same audience globally – it’s an alluring thought… the Premier League is incredible here and it’s growing around the world, but it’s disproportionately larger here than there.”

Georgiou added: “There are pockets of opportunity but, fundamentally, sport is local content.”

“The big money is invariably in your domestic territory,” said Airey. “Will that change? Interesting question. Will one of the big streamers come along?

“At the moment we look quite traditionally at the best domestic deal one can do and get, off the back of that, the best international distribution. That’s a pretty standard model.”

Do traditional sports broadcasters feel threatened by the big US tech companies, asked Adepitan, suggesting that “[for now] they’re just dabbling”.

“It’s true but you could read that both ways,” said Van Rooyen. “They are very rational about what they do… no one is blowing their brains out on buying something. That might happen – who knows? You can’t do anything if they decide to do that.”

“They’ve made a bigger move in the US,” said Segev, where Amazon has bought the rights to Thursday-night NFL games and Apple shows Major League Soccer matches. “But it’s a different business model outside the US.”

“It’s difficult to speculate about what they’ll do because they could do anything – they have the capability to do everything,” added Georgiou.

“What we can talk about is what they have done. And what they have done has been quite rational [in terms of] what sport is doing for their core businesses… if it becomes irrational, then hang on to your hats.”

Session Five, ‘Kicking and streaming: the ever-changing sports media landscape and what comes next’, was hosted by TV presenter and Paralympic medallist Ade Adepitan and featured: Dawn Airey, Chair, FA Women’s Super League and Women’s Championship Football; Andrew Georgiou, President and MD, Warner Bros. Discovery UK and Ireland and Warner Bros. Discovery Sports Europe; Stephen van Rooyen, CEO, Sky UK and Ireland and Group Chief Commercial Officer; and Shay Segev, CEO, DAZN. The producer was Joe Blake-Turner. Report by Matthew Bell.